How to Buy an Apartment in Miami as a Foreigner

Why Investing in a Condo in Miami as a Foreigner Is a Great Opportunity

Stability, Profitability, and Hassle-Free Access

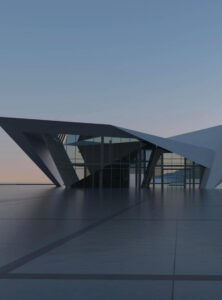

Miami has become one of the favorite destinations for foreign investors seeking legal security, sustained appreciation, and income generation in U.S. dollars. Unlike other countries where foreign ownership may be limited or subject to complex tax restrictions, in Miami you don’t need to be a resident or hold a special visa to purchase property. This direct access to the market makes it especially attractive for those who want to diversify their wealth safely.

Investing in a condo in Miami means owning an asset in a global city, where the constant demand for both short- and long-term rentals allows you to generate stable income. In addition, property values have shown a sustained growth trend, backed by modern infrastructure, international migration, and strong economic development.

Legal Requirements for Foreigners Who Want to Buy in Miami

Mandatory Personal Documentation

Buying property in Miami as a foreigner is an accessible process, as long as you have the basic required documentation. The essential documents include a valid passport, tourist or business visa, proof of residence in your country of origin (such as a utility bill or bank statement), and in some cases, personal or business references that validate your financial solvency or history.

Having this documentation ready from the start speeds up the process with real estate agents, banks, and attorneys.

Proof of Funds and Lawful Source of Money

One of the most important requirements is to demonstrate the lawful origin of the funds that will be used for the purchase. This can be done through recent bank statements, accounting certifications issued by a professional, or tax returns from the country of residence. This verification is key to complying with U.S. anti-money laundering laws.

No Investor Visa Required

A major advantage of the U.S. market is that you do not need an investor visa to purchase property. With just a tourist visa, you can acquire, own, and rent a property. However, this visa does not grant permanent residency.

Stages of the Process of Buying a Condo in Miami

Define the Budget and Area of Interest

The first step in buying a condo in Miami is to set a clear budget and define the preferred area. Neighborhoods such as Brickell, Downtown, Edgewater, and Miami Beach are highly recommended due to their consistent appreciation and high rental demand. A good advisor will help you evaluate average prices, estimated returns, and compatibility with your investment goals.

Choose a Realtor Experienced in International Buyers

Having a real estate agent specialized in foreign clients makes a big difference. This professional will guide you throughout the entire process—from property search to negotiation, legal coordination, and closing—optimizing time and avoiding common mistakes.

Make the Offer and Sign the “As Is” Contract

Once you find the right property, a formal offer is presented through an “As Is” purchase contract, which is common in Florida. This includes an inspection period, an initial deposit (usually between 5% and 10%), and an estimated closing time of 30 to 60 days.

Property Inspection and Legal Title Review

During the inspection period, you can cancel the purchase without penalty if you are not satisfied. A title company is responsible for verifying that the property is legally fit to be transferred.

Closing the Purchase and Receiving the Title Deed

The closing is the moment when the final signature takes place and the keys are delivered. The best part: you can sign electronically from your home country without the need to travel.

Financing Options for Foreigners

Cash Purchase vs. International Mortgage Loan

Although many foreign investors choose to buy in cash—mainly for speed and less paperwork—there are financing options available for non-residents. Banks and private lenders in the United States offer international mortgage loans, ideal for those who want to leverage their investment and maintain liquidity.

These types of mortgages are designed specifically for foreigners who do not have a U.S. credit history, although they usually require more documentation and a higher down payment.

Requirements to Obtain a Mortgage Loan

To access a mortgage as a foreign buyer, the following are usually required:

- Proof of income (official translation if in another language)

- Bank references

- U.S. bank account

- Net worth statement signed by an accountant

- Between 3 and 6 months of bank statements

As for conditions, loans for non-residents generally offer rates between 4.5% and 6.5%, with flexible terms depending on the buyer’s profile and the financial institution.

Common Mistakes When Buying in Miami as a Foreigner (And How to Avoid Them)

Not Hiring a Realtor Specialized in International Clients

One of the most frequent mistakes is trying to buy without the guidance of a realtor who understands the needs of foreign buyers. A specialized advisor knows the legal processes, required documentation, and the best areas to invest in. In addition, they protect you from falling into misleading offers or unfavorable conditions.

Not Properly Verifying the Legal Status of the Property and Maintenance Costs

It is essential to ensure that the property is legally clear, with no title issues or outstanding debts. You must also be aware of condominium maintenance fees, as they can vary significantly between properties and impact your final profitability.

Not Planning the Use of the Property

Before purchasing, it’s vital to determine whether the property will be used for vacation rentals, seasonal rentals, or long-term investments. This influences the choice of location, property type, and tax strategy.

Not Reviewing Condominium Rental Restrictions

Some buildings have minimum rental terms or do not allow short-term rentals, which can affect your income plan. Always review the condominium rules before signing.

Your Condo in Miami Is Closer Than You Think

Investing in Miami as a Foreign Buyer Is Easier Than It Seems

Buying a condo in Miami from abroad is not only possible, but it is also one of the smartest financial decisions you can make in 2025. The city offers legal certainty, rental income in U.S. dollars, and a real estate market fully open to non-residents. You don’t need a special visa, you can access financing if required, and best of all: with the right guidance, you can complete the entire process remotely.

Miami’s real estate market continues to show high demand, steady appreciation, and modern infrastructure that supports its long-term growth. Whether you’re looking to generate income, have a vacation home, or protect your assets, you’ll find a property here that fits your goals.

Contact one of our experts for a Free Consultation and discover, step by step, how to buy your condo in Miami — wherever you are. With our personalized guidance you’ll avoid common mistakes, identify real opportunities, and become an owner in one of the most dynamic cities in the world.