Tax Benefits of Investing in Real Estate in Miami

Why Tax Advantages Are Key When Investing in Real Estate in Miami

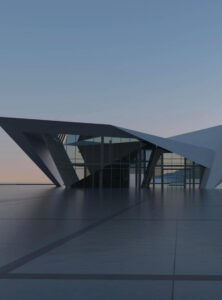

Miami: A Real Estate Paradise with Unique Tax Incentives

Investing in real estate in Miami not only means acquiring a property in one of the most sought-after markets in the world, but also gaining access to tax benefits that can significantly maximize the profitability of your investment. This city has established itself as a magnet for global investors thanks to its economic stability, growth potential, and, above all, its favorable tax environment.

Florida has no state income tax, which represents a clear advantage compared to other markets. Additionally, the tax system favors both domestic and international buyers, removing many of the common fiscal barriers found in other U.S. states. This is especially relevant for foreign or high-net-worth investors, who find in Miami a perfect combination of asset security and tax efficiency.

General Context of the Real Estate Market in Miami

Economic and Demographic Growth

Miami has become one of the most dynamic economic engines in the United States. The steady growth of Florida’s GDP, combined with strong internal and international migration, has transformed the city into a hub of opportunities for real estate investors. High-profile professionals, international entrepreneurs, and entire families are choosing Miami as their new home, which drives demand for residential and multifamily properties.

This demographic and economic expansion creates a solid environment for those looking to invest in real estate, as it guarantees an active and growing user base. Furthermore, the state’s fiscal stability further enhances the financial attractiveness of the market

High Rental Demand and Constant Appreciation

Alongside population growth, property prices in Miami have shown a sustained upward trend. This is coupled with high rental demand, especially in areas like Brickell, Downtown, and Edgewater. This translates into consistent income for property owners and an excellent rate of return.

These conditions make tax benefits, such as the exemption from state income taxes, a strategic factor.

Main Tax Benefits When Investing in Real Estate in Miami

No State Income Tax

One of the most powerful reasons to invest in real estate in Miami is that the state of Florida does not charge personal income or inheritance taxes. This means that income generated from rentals or profits from the sale of a property can be fully enjoyed at the state level, without local tax erosion. This benefit has a significant impact on the investor’s net profitability, especially when compared to markets in states like California or New York.

Deduction of Operating Expenses

As a property owner, you can deduct a wide range of operating expenses: maintenance, property management, insurance, mortgage interest, improvements, and more. These deductions directly reduce the taxable base, lowering the total amount of federal taxes owed. It is a fundamental tool for optimizing cash flow.

Accelerated Property Depreciation

In the U.S., residential properties depreciate over 27.5 years and commercial properties over 39 years. While the land itself does not depreciate, the structure does, allowing for annual tax reductions. For example, if you purchase a property for $550,000, you could deduct around $20,000 annually, depending on the value assigned to the structure.

1031 Exchange: Capital Gains Tax Deferral

Section 1031 of the tax code allows you to defer capital gains taxes if you reinvest in a similar property. This is ideal for investors who want to expand their portfolio without liquidating gains and paying taxes immediately. Imagine selling a condo with a $100,000 gain and reinvesting it without paying taxes now; that capital continues to work for you.

Benefits for International Investors

Foreign investors can structure their investment through LLCs or trusts, which improves tax efficiency and protects their assets. Additionally, there are tax treaties between the U.S. and countries such as Mexico, Colombia, Spain, or Argentina that help avoid double taxation.

Comparison of Tax Benefits: Florida vs. Other States

States with High Taxes (e.g., California, New York)

Investing in real estate in Florida, particularly in Miami, offers far superior tax advantages compared to states like California or New York. The latter impose high state income taxes that significantly reduce the investor’s net cash flow.

Let’s consider a practical example: a rental property worth $1 million generating $60,000 in annual net income. In New York, the owner could pay up to 10% in state taxes, reducing net income to $54,000. In contrast, in Florida, that income remains intact at the state level, equivalent to an immediate annual saving of $6,000, not including additional benefits such as depreciation and operating deductions.

Benefits for Estate Planning

Florida also offers a strategic advantage for estate planning. With no state inheritance tax, it is possible to transfer properties to heirs without facing a high tax burden, as occurs in other states. With proper planning, real estate assets can pass to the next generation efficiently and securely.

How to Leverage These Tax Benefits in Your Investment Strategy

Smart Legal Structuring

One of the keys to maximizing tax benefits when investing in real estate in Miami is choosing the right legal structure. Forming an LLC or an S-corporation can help reduce your tax burden, protect your assets, and simplify property management. For example, an LLC allows you to separate your personal assets from real estate holdings, limiting your liability in the event of any legal or financial issues.

Additionally, depending on your country of residence or immigration status, properly structuring your investment can help avoid double taxation. It is essential to have specialized accounting and legal advice to set up the best strategy according to your profile, objectives, and level of tax exposure.

If you wish, we can help you structure your investment safely, profitably, and efficiently. Contact one of our experts for personalized guidance.

Long-Term Portfolio Planning

Taking advantage of tax benefits is not just about saving on taxes, but about building a portfolio that grows intelligently over time. A solid strategy can include the accumulation of annual depreciation, the use of a 1031 exchange to reinvest without paying taxes immediately, and diversification across different areas of Miami to mitigate risks.